Bitcoin, the pioneering cryptocurrency, operates on a decentralized network maintained by a technology called blockchain. One of the essential elements governing Bitcoin's supply and, subsequently, its value is the concept of Bitcoin halving. In this article, we will delve into what Bitcoin halving is and explore its influence on the price of Bitcoin.

What Is Bitcoin Halving?

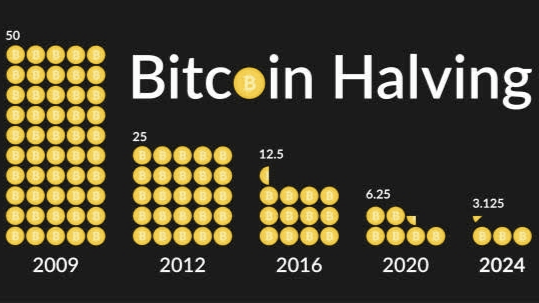

Bitcoin halving is an event that occurs approximately every four years, or after every 210,000 blocks are mined on the Bitcoin network. During this event, the reward that miners receive for validating transactions and securing the network is reduced by half. In the early days of Bitcoin, miners received 50 BTC per block. After the first halving in 2012, the reward was reduced to 25 BTC. The second halving occurred in 2016, bringing the reward down to 12.5 BTC. The most recent halving took place in May 2020, reducing the reward to 6.25 BTC.

How Does Bitcoin Halving Affect BTC Price?

1. Supply and Demand Dynamics

Bitcoin halving directly impacts the supply of new Bitcoins entering the market. With the reduced reward, the rate at which new Bitcoins are generated slows down significantly. This decrease in the supply growth often leads to an increase in demand, as Bitcoin becomes scarcer.

2. Scarcity and Perceived Value

Similar to precious metals like gold, scarcity enhances the perceived value of Bitcoin. As the supply reduces due to halving, Bitcoin's scarcity factor is accentuated, potentially driving up its price. Investors tend to anticipate this scarcity, which can create a bullish sentiment around the time of halving events.

3. Historical Price Trends

Historical data indicates that Bitcoin price has experienced significant rallies following previous halving events. While past performance doesn't guarantee future results, these patterns contribute to the belief that halving events positively influence Bitcoin's value.

4. Market Sentiment and Speculation

Bitcoin halving events often garner significant media attention and hype within the cryptocurrency community. This heightened interest can lead to increased trading activity and speculative investment, further influencing the price dynamics of Bitcoin.

Conclusion

Bitcoin halving is a fundamental mechanism embedded in the cryptocurrency's protocol, shaping its economic model and impacting its price. By reducing the rate of new Bitcoin issuance, halving events contribute to the digital currency's scarcity, potentially driving up demand and, consequently, its market value. However, it's crucial to note that while halving events have historically been associated with price surges, the cryptocurrency market is highly volatile and influenced by various factors. Investors should exercise caution and conduct thorough research before making any investment decisions related to Bitcoin or any other cryptocurrencies.